Inflation is trending down to the Fed’s target 2% and interest rates are expected to follow lower. Looking into 2025 and beyond, I believe our diversified portfolio of market-leading franchises is well positioned to deliver strong results given the deeply discounted valuations and prospects for robust long-term earnings growth. I want to underscore that it is very rare to see assets of this caliber collectively trading at such cheap prices. As testament to my conviction in our Partnership’s profit potential, I invested 100% of my 2024 fees into the Fund (as I have done every year since inception).

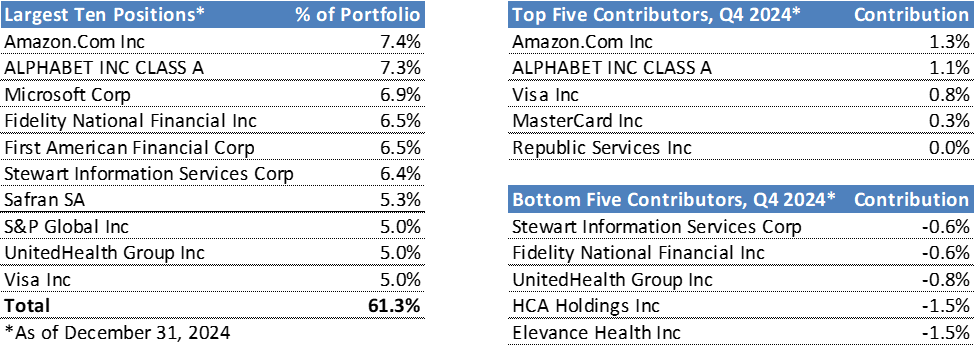

Late in the quarter we observed bizarre market dislocations that provided extraordinary investment opportunities. First, the election results fueled a buying frenzy in highly speculative, volatile assets and a selloff of defensive, profitable businesses. This rotation was exacerbated by a selloff in bonds (and equities that are bond-proxies) due to speculation that the new administration’s pro-growth policies could reignite inflation and reduce funding for businesses exposed to government spending. Second, the assassination of Unitedhealth Group’s insurance CEO drove a deeper selloff in an already battered Health Care sector as traders feared a government response in sympathy to the murderer and his supporters on social media. These transitory dynamics gave us the rare opportunity to increase our allocations to defensive sectors at trough valuations and highly attractive multiple-of-money potential.

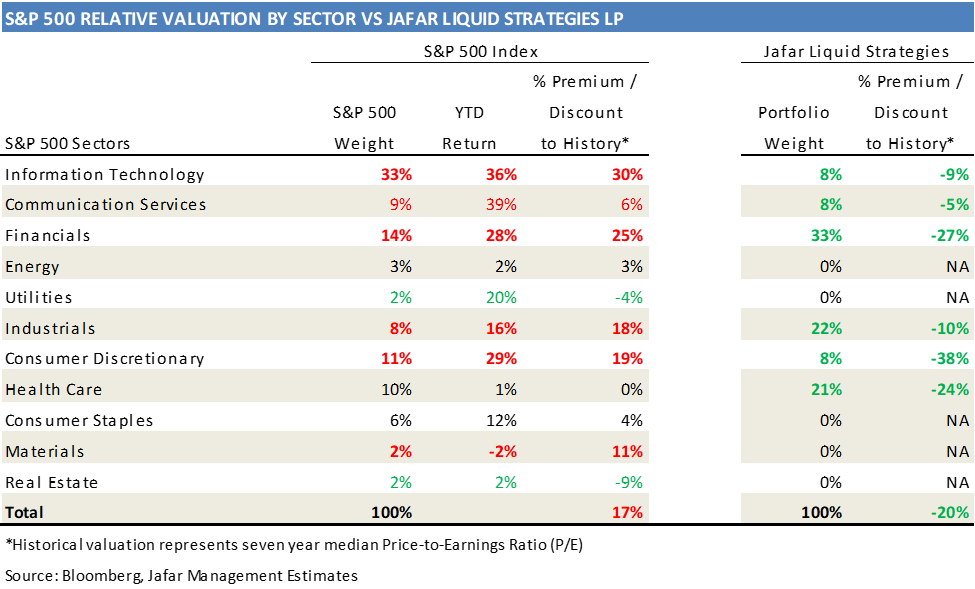

The table below reflects the portfolio reshuffling, the significant relative and absolute discount embedded in our portfolio, and supports my excitement about our Partnership’s prospects. The S&P 500 trades at a frothy +17% premium to its historical valuation whereas our portfolio trades at a 20% discount to our assets’ historical valuations. Our diversified portfolio of dominant, high-quality businesses is advantageously priced relative to every corresponding sector represented in the S&P 500, while offering an attractive bond-like 5% earnings yield (and growing), 1.5% dividend yield (and growing), beta of 0.8, cash-like liquidity, and multiple-of-money potential.

Portfolio Update

I took advantage of the transitory interest rate and election driven volatility to increase our allocations to dominant companies in defensive sectors near trough valuations. I funded these opportunistic investments by trimming areas of our portfolio not impacted by these dynamics and exiting Lamb Weston as I believe its end market recovery will take longer than I originally expected. I believe our entire portfolio is comprised of market leading franchises trading at relative and absolute discounts – a rare dynamic that I believe positions us well for the years ahead. While the entire portfolio trades at a discount, our most significant allocations are also among those sectors with the greatest dislocation. Specifically, our investments in the Real Estate (technically “Financials”) and Health Care sectors represent some of the most powerfully entrenched entities that serve as essential infrastructure and toll-takers to these critical industries.

Real Estate Investments (~24% of portfolio)

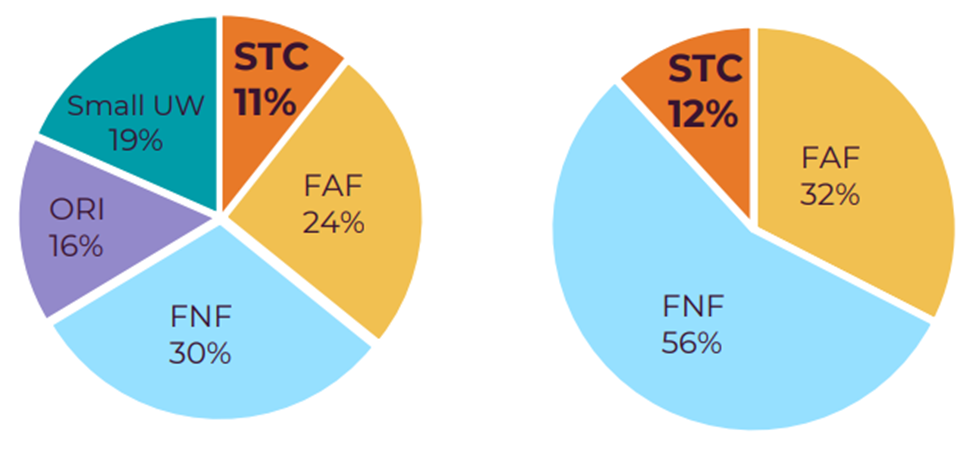

Our investments in the real estate industry are members of an oligopoly that control 81% of all transactions involving Title Insurance and 100% of the commercial Title Insurance market. They collect a fee every time real estate is bought/sold and payout claims in the very rare event there is a title error (only ~3-4% loss rate) – an enviable toll-taking position atop a nearly $70 trillion U.S. Real Estate market.

Title Insurance Market Share Commercial Title Market Share

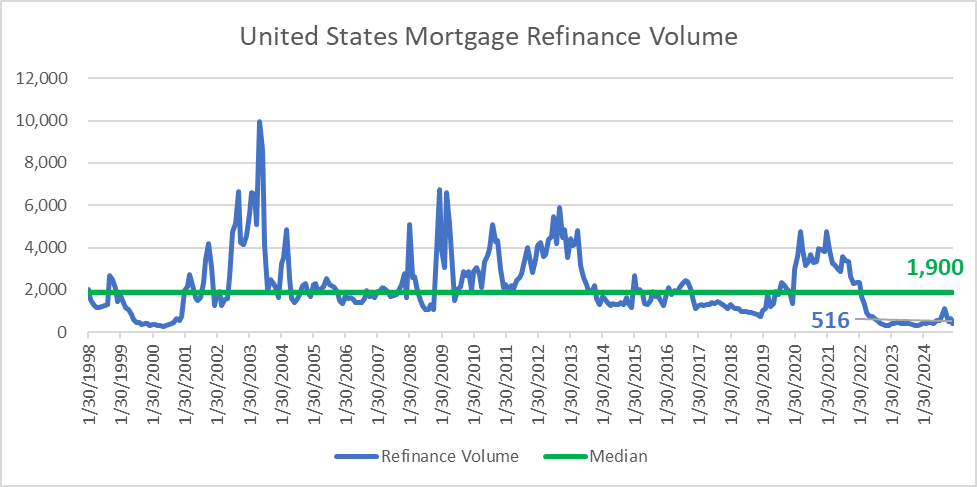

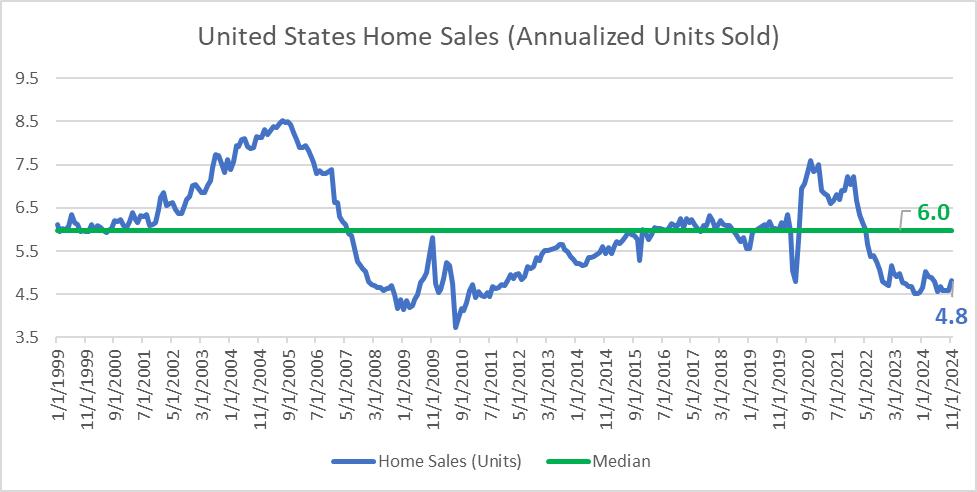

Real estate transactions and mortgage refinance activity are significantly below normal demand which is +25% and +268% above current activity levels, respectively.

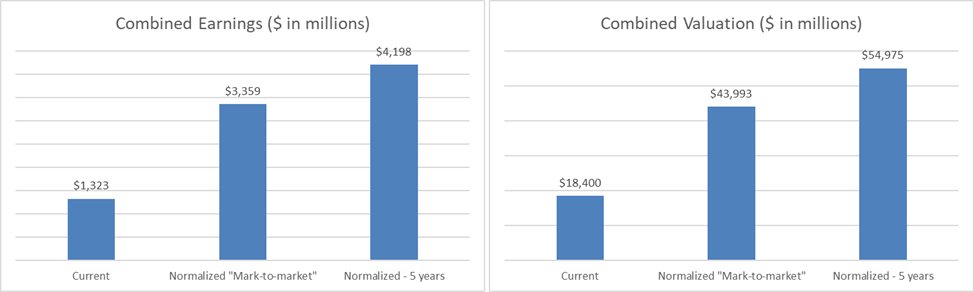

The charts below illustrate the +150% increase in the collective profitability of our companies assuming a return to normal demand today (“mark-to-market”) and +215% increase in profitability assuming the return to normal demand occurs gradually over 5 years. Considering historical valuation for these assets implies 2.4x and 3.0x multiple-of-money on our investment. Real estate activity levels have been depressed for nearly three years and there is potentially pent-up demand over +100% of current activity levels. Please note, I have not included pent-up demand in the return to normalization analysis – representing potential upside to our estimates in the event it materializes.

Health Care Investments (~21% of portfolio)

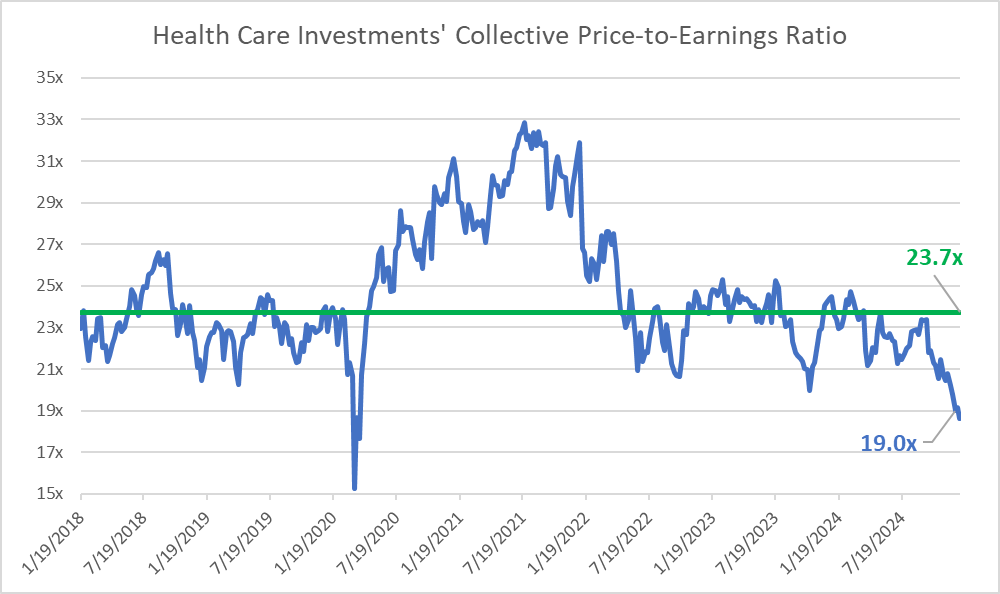

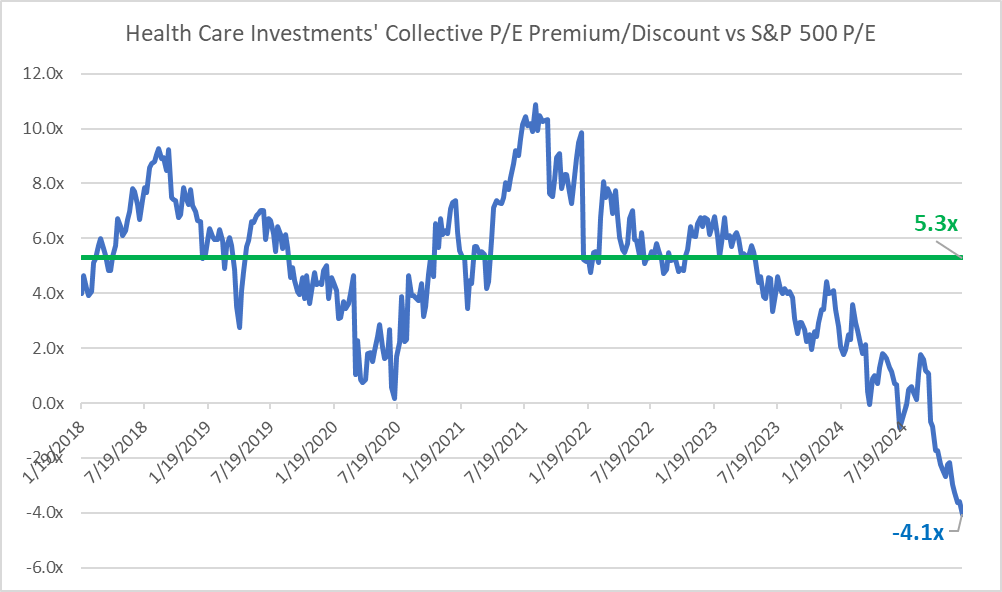

Our collective investments in the Health Care industry represent critical infrastructure including the largest and most dominant companies in health insurance, private hospitals, and veterinary diagnostics. Sentiment for the sector turned deeply negative due to the election as short-term traders rotated into speculative assets / “pro-Trump” industries and sold defensive sectors especially those that have exposure to government spending/regulation. The assassination of the Unitedhealth insurance CEO in December led to further sentiment deterioration for the sector. The charts below illustrate the magnitude of this sentiment shift as these assets historically trade for a +5.3x premium to the S&P 500 and now trade for a -4.1x discount! I believe this is a virtually unprecedented investment opportunity to own high-quality assets in a defensive sector with +25% upside as valuations normalize which combined with their +10-15% long-term earnings growth represent greater than a 2x multiple-of-money on our investment.

As a fiduciary and long-term investor with a focus on preserving and growing generational wealth, I believe it is important to emphasize quality as an investment criterion. All our portfolio investments have dominant market positions, gain share in their growing industries, and possess strong pricing power – characteristics which drive expanding, durable cash flows that ultimately determine healthy investment returns. I am excited to own this collection of toll-taking franchises and believe their significant discount, robust earnings growth, and potential outsized benefits from Artificial Intelligence position our Partnership well for future investment returns. My family balance sheet remains fully invested and I am grateful to be in your service. Thank you for your trust and please feel free to reach out anytime.

Your partner and fiduciary,

Faris Jafar, Chief Executive Officer

Phone: (734) 678-8562

Email: fsj@jafarmanagement.com