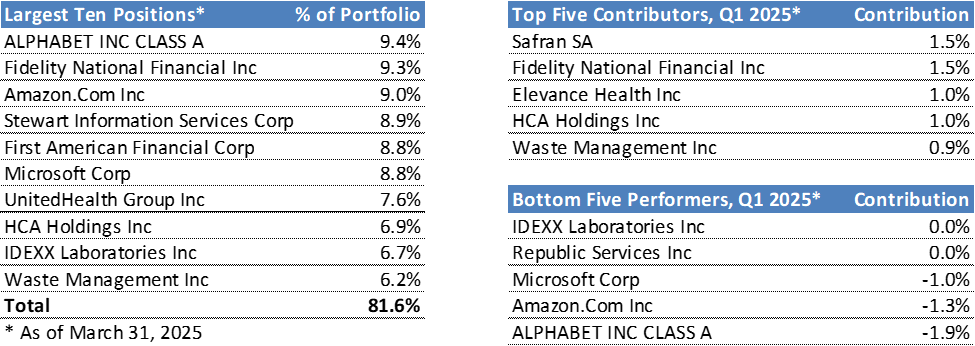

Current inflation readings are trending lower and the Federal Reserve is lowering interest rates. Despite the progress on inflation, market sentiment turned negative due to uncertainty around U.S. trade policy, government spending cuts, Artificial Intelligence, and signs of a slowing economy. Portfolio performance was aided by our defensive posture via an avoidance of the frothiest pockets of the market and allocations to market-leading franchises at trough valuations. Strong performance from our Health Care, Industrials and Financials investments more than offset weakness in “Big Tech”. I believe our diversified portfolio of dominant toll-taking businesses is well positioned to deliver strong results as their structural growth tailwinds and underappreciated A.I. automation potential drive windfall profits while their deeply discounted valuations offer an attractive risk / reward skew in our favor.

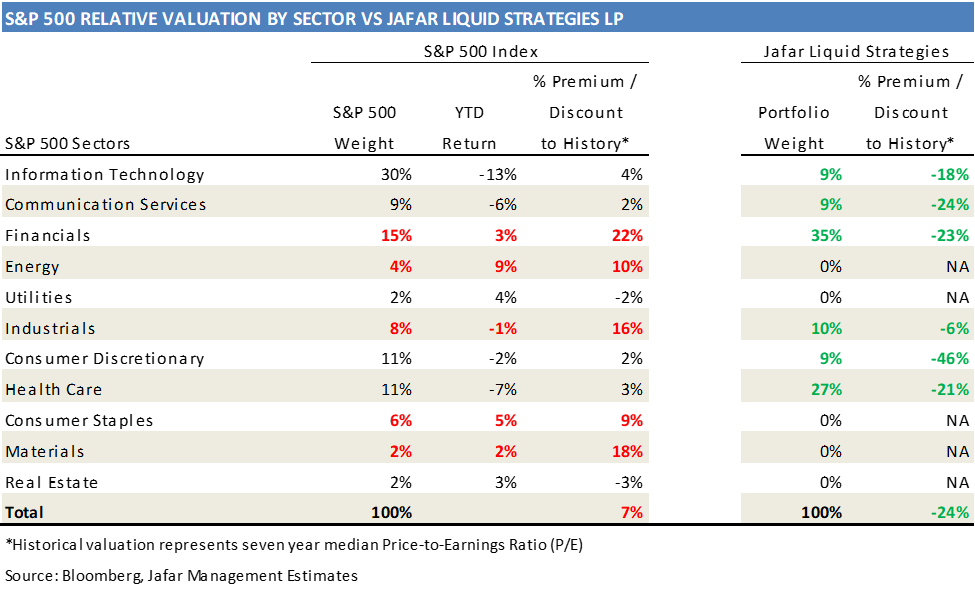

The table below shows the absolute and relative discount embedded in our portfolio which I believe represents a rare opportunity to own a collection of high-quality businesses at extraordinarily cheap prices (-24% below historical valuation). On the other hand, the S&P 500 trades for a +7% premium to its historical valuation and is more expensive across every sector relative to our respective sector allocations. I believe we are positioned for strong absolute returns and my actions during the quarter help amplify our multiple-of-money potential (more on this below).

Portfolio Update

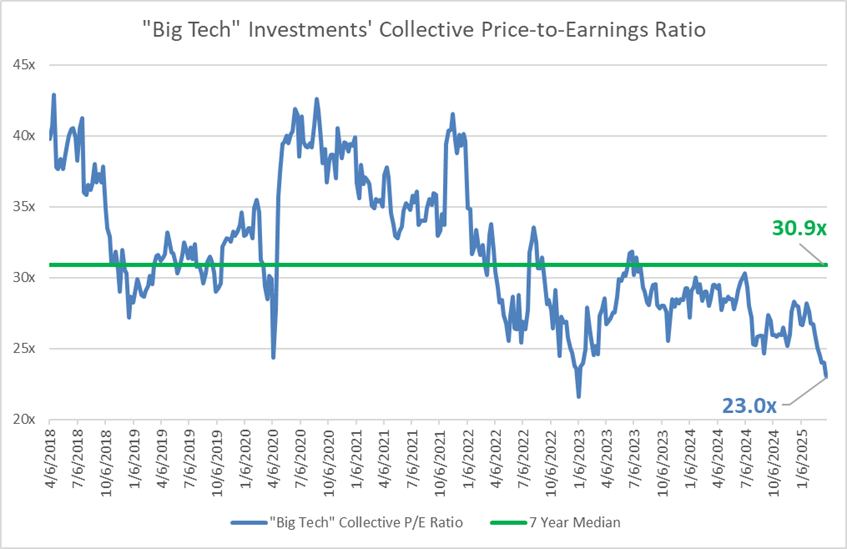

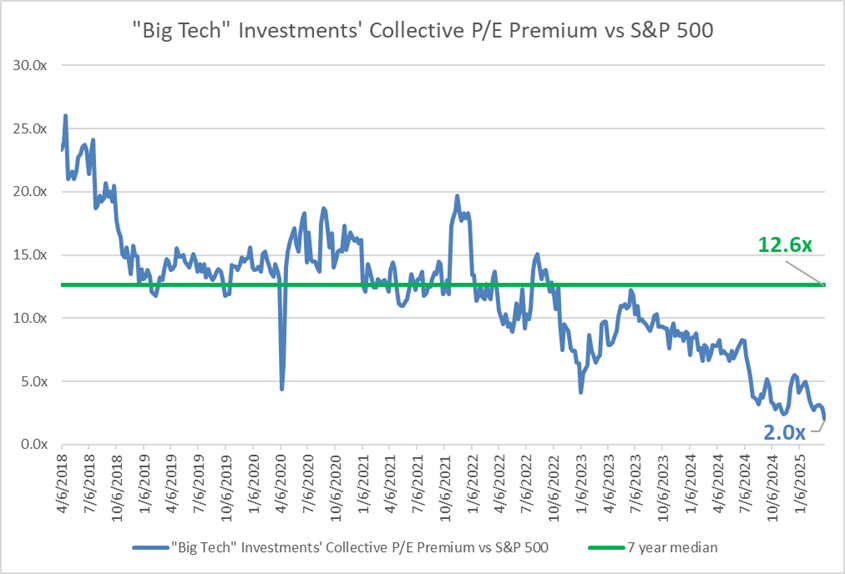

During the quarter I reduced our allocations to Industrials, Digital Payments (“Financials”) and the Ratings Agencies (“Financials”). All of these are fantastic businesses that have performed very well for our Partnership and I would happily buy them back at the appropriate time. I utilized the proceeds from the sale of those investments to increase our allocations to sectors at trough valuations that I believe have significantly better future investment return potential, specifically: Housing, Healthcare, and “Big Tech”. In my prior letter I touched on the dislocation and opportunity of the first two sectors so the following charts will focus on our “Big Tech” investments. In short, these investments represent some of the most dominant companies on the planet and are trading at the lowest absolute and relative valuation in recent history.

On a consolidated basis, our portfolio of diverse, dominant, and resilient franchises offers an attractive 5.25% earnings yield, 1.5% dividend yield and beta of 0.8. Considering these factors, I believe the expected return profile of our partnership is very exciting and is significantly more favorable than alternative investment opportunities. My family balance sheet remains fully invested with you and I am excited about our future. Thank you for your trust and please feel free to reach out anytime.

Your partner and fiduciary,

Faris Jafar, Chief Executive Officer

Phone: (734) 678-8562

Email: fsj@jafarmanagement.com